Creditors freeze many credit reports to prevent ID theft. But if you’re looking for a new job or applying for loans, you may need to unfreeze your credit report to pass background checks. The process of unfreezing your credit report is called thawing and can be done in one of two ways:

1) Through a third-party consumer reporting agency (CRA).

2) With each CRA directly. For both processes, you must have proof of identity before beginning so that all parties involved are certain they are working with the correct individual (s).

Below, we’ll discuss how you can thaw your credit report through both methods. Thawing Through a Third-Party CRA: If you believe there may be inaccurate information on your credit report—or want to freeze/thaw your credit report for other reasons—you will need to contact one of three different organizations. Those include Experian, TransUnion, and Equifax.

Each company handles requests differently, but generally, you must fax or email them documentation that proves who you are. After doing so, these organizations will run verification checks to ensure their customers are indeed who they say they are before further action on freezing/unfreezing requests.

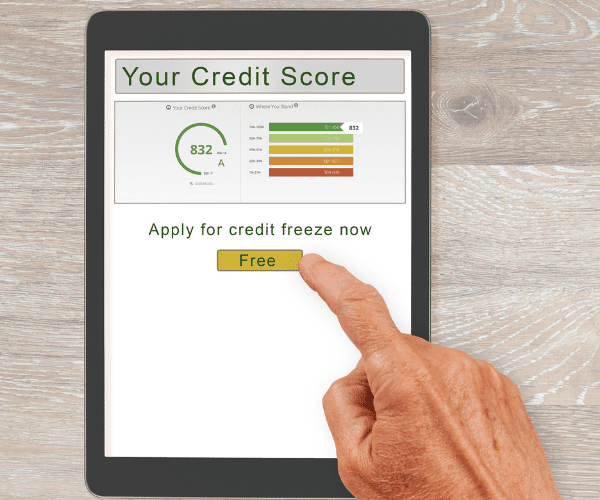

Freezing your credit file is a good way to prevent identity theft. As long as your credit file is frozen, no one can check it or open an account in your name. Freezing isn’t typically free—but you do have options. Depending on where you live, it might be possible for you to freeze your file for free, either through a government program or with a company that does business in your state. The catch is that unless you find out before fraud occurs, you’ll have to pay up each time you want unfreeze access again. If you know ahead of time, though, you can take advantage of freezes that are essentially permanent. It’s a great idea if you think many issues could arise over time and figure it would be worth paying now to avoid going through them later down the road.

These permanent freezes tend to cost money upfront but usually are cheaper over longer periods. In any case, make sure any agency offering these services spells out all fees and has consumer-friendly policies in place before moving forward.

The purpose of a credit freeze is to block any access to your file, which makes it significantly more difficult for identity thieves to open new accounts in your name. Until you unfreeze your report, even you will be blocked from opening new lines of credit. It may not prevent every instance of fraud, but all consumers must take steps to protect themselves and their assets. That said, freezing your credit file does come with some downsides.

For one thing, each time you freeze or unfreeze, it can cost between $5 and $10 – and sometimes more – depending on where you live and who does it for you. Also, there are instances when you might want access to your credit score without having to go through an official freeze. A good example would be when you’re shopping for a mortgage. As long as you do so sparingly and pay off your bills on time, it shouldn’t have much impact on your overall financial health.