Credit restoration is crucial to financial stability and achieving your long-term financial goals. Whether you aim to buy a home, start a business, or qualify for better interest rates, improving your credit score is essential. Fortunately, there are several strategies you can implement to restore your credit successfully. In this blog post, we’ll discuss eight quick tips to help you toward successful credit restoration.

1. Obtain and Review Your Credit Reports:

The first step in the credit restoration process is to obtain copies of your credit reports from all three major credit bureaus: Equifax, Experian, and TransUnion. Reviewing your credit reports will help you identify any errors, inaccuracies, or negative items that may impact your credit score.

2. Dispute Inaccurate Information:

If you find any errors or inaccuracies on your credit reports, don’t hesitate to dispute them with the credit bureaus. You can initiate disputes online or by mail, providing documentation to support your claims. The credit bureaus are required by law to investigate your disputes and correct any errors within a reasonable timeframe.

3. Pay Your Bills on Time:

One of the most critical factors in determining your credit score is your payment history. Make sure to pay all your bills on time, including credit card payments, loan payments, and utility bills. Late payments can significantly negatively impact your credit score, so staying current on your financial obligations is essential.

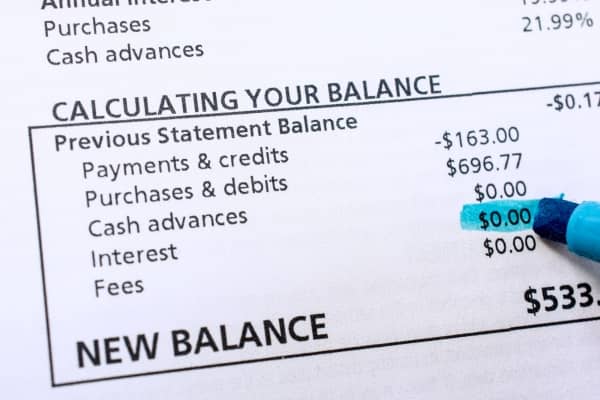

4. Reduce Credit Card Balances:

High credit card balances relative to your limits can harm your credit score. Aim to keep your credit card balances below 30% of your available credit limit. Paying down your credit card balances can improve your credit utilization ratio and positively impact your credit score.

5. Avoid Opening Too Many New Accounts:

Opening multiple new credit accounts quickly can raise red flags to lenders and may lower your credit score. Avoid opening new accounts unless necessary, and be cautious about applying for new credit cards or loans.

6. Use Credit Monitoring Services:

Consider enrolling in credit monitoring services to monitor changes to your credit reports and receive alerts about potential fraudulent activity. Our services offer features like credit score tracking, identity theft protection, and personalized credit improvement tips.

7. Consider a Secured Credit Card:

If you’re struggling to qualify for traditional credit cards due to past credit issues, consider applying for a secured credit card. Secured credit cards require a cash deposit as collateral, making them easier to obtain for individuals with poor or limited credit history. Responsible use of a secured credit card can help rebuild your credit over time.

8. Seek Professional Assistance if Needed:

Feel free to seek professional assistance if you’re overwhelmed or need help with credit restoration. Credit counseling agencies and reputable credit repair companies offer services designed to help individuals improve their credit scores and navigate the credit restoration process more effectively.

Conclusion:

Successfully restoring your credit takes time, effort, and discipline, but it’s well worth the investment in your financial future. By following these eight quick tips and staying committed to improving your credit, you can take control of your financial destiny and achieve your goals. Remember, patience and persistence are key, and with the right strategies in place, you can overcome past credit challenges and pave the way toward a brighter financial future.