Credit restoration services can help individuals repair their credit and get back on track to financial success. Whether you’re looking to make a big purchase, get a loan, or just want to improve your credit score, these services can be incredibly beneficial. Here are 7 benefits of using credit restoration services that are worth considering.

1: Improve Your Credit Score

One of the main benefits of using credit restoration services is that they can help you improve your credit score. Your credit score is an important factor in determining whether or not you’ll be approved for a loan, credit card, mortgage, or other types of financing. You to identify any errors or inaccurate information on your credit report, and then work to get them corrected. This can help raise your credit score and make you more eligible for the type of financing you need. We also provide you with personalized advice and guidance on how to manage your finances and improve your credit score in the long term. With the help of these services, you can be sure that your credit score is as high as possible.

2: Get Out of Debt

If you’re struggling to pay off large amounts of debt, credit restoration services can help. These services will provide you with assistance in creating a budget and finding ways to pay off your debt faster. They can also help negotiate with creditors to reduce interest rates and fees. This can help you get out of debt quicker, allowing you to save money on interest payments. Credit restoration services can also work to dispute any inaccurate information that is hurting your credit score, making it easier for you to get out of debt and start saving.

3: Raise your Credit Limit

One of the benefits of using credit restoration services is the ability to raise your credit limit. Credit repair experts will work to dispute any incorrect items on your credit report that could be causing your credit score to suffer, and they can also help you negotiate a higher credit limit. This will not only help you reduce your overall debt-to-income ratio, but it can also give you greater purchasing power. You’ll be able to unlock better rates, terms, and offers from lenders, as well as increased access to financing. Having access to a higher credit limit can make a big difference in your overall financial health, and can also provide peace of mind knowing that you have the necessary funds to take care of your expenses.

4: Remove Negative Items from your Credit Report

Credit restoration services can help you remove negative items from your credit report. Negative items such as late payments, collections, charge-offs, bankruptcies, and foreclosures can have a damaging effect on your credit score and your ability to access new lines of credit. Credit restoration services can help by working directly with the credit bureaus and other creditors to get these negative items removed from your report. This process can take time and involve complex negotiations, so it is best to enlist the help of a professional who has experience in this area. With the help of credit restoration, you can get the negative items off your report and start improving your credit score.

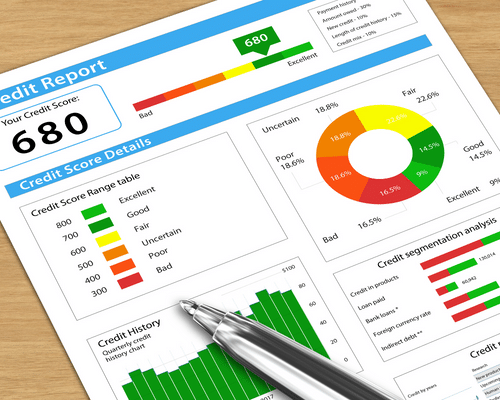

5: Fix Errors on Your Credit Report

Mistakes can happen, and unfortunately, they can affect your credit report. Fortunately, credit restoration services can help you repair inaccurate information on your credit report. Credit restoration services can work with the credit bureaus to correct any errors or inaccuracies that could be damaging your credit score. This can include anything from outdated addresses to incorrect payment histories. It’s important to dispute any discrepancies with the credit bureaus, as this could give you a chance to get your score back up. With the help of credit restoration, you can make sure that your credit report is up-to-date and accurate.

6: Save Money on Interest

Using credit restoration services can help you save money on interest. When your credit score is low, you’re more likely to be charged higher interest rates on loans, credit cards, and other financial products. By improving your credit score with credit restoration services, you can potentially get access to lower interest rates and save hundreds or even thousands of dollars in interest payments. This can make a huge difference in how quickly you pay off debts and the amount of money you’re able to save for retirement or other investments. Can also help you avoid late fees, as many lenders and creditors will waive late fees for borrowers who have improved their credit scores.

7: Protect Your Identity

Credit restoration services offer protection against identity theft. By fixing errors on your credit report and removing negative items, you’re protecting your credit score and thus protecting your personal information. As a result, you’re less likely to become a victim of identity theft. Many credit restoration services also provide additional identity theft protection by monitoring your credit for suspicious activity and alerting you if anything arises. This gives you the peace of mind that your credit and personal information is safe from fraudulent activity.